Posts

Showing posts from September, 2010

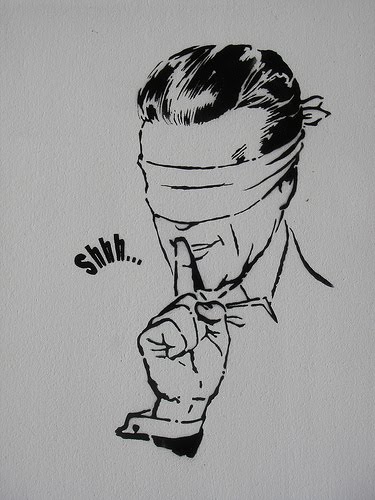

what ishappening in the Benami transactions act: the rules not framed for the last 22 years: The story of a Betrayal

- Get link

- Other Apps

Govt revamping Benami Transaction Act to keep check on black money Hush Hush Black money: Indiamoneyback.blogspot.com Shruti Srivastava Posted online: Mon Sep 20 2010, 09:03 hrs New Delhi : Worried over the speedy growth of a parallel economy in the country, with black money amounting to almost one-fourth of India’s GDP, the government is planning to crack down on such illegal transactions, at least those related to property. The finance ministry is revamping the Benami Transaction Act, 1988, to keep a check on such transactions, which are entered into for avoiding taxes and hiding accumulated assets. Though there exists the Benami Transactions (Prohibition) Act, 1988, prohibiting benami transactions and providing for government acquisition of the property held benami, the rules to make confiscation of property and other provisions effective have not been issued due to several lacunae in the Act. Sources told The Indian Express that the Central Board of Direct Taxes has start

Is India headed to be a Tax Haven

- Get link

- Other Apps

NEW DELHI - India’s Finance Ministry Sept 13 said safe harbor rules—a set of norms that would enable the income tax (I-T) authorities to accept without scrutiny the tax returns by the Indian units of foreign companies—would be soon put in place. “Safe harbor rules are at an advanced stage of consideration. I can’t share how the guidelines are going to be...it will be a very favorable program... we are working on it and it will be in place as early as possible,” Central Board of Direct Taxes Chairman S S N Moorthy said at a seminar here. He said the norms would be taxpayer friendly. The Central Board of Direct Taxes (CBDT) has set up a committee to formulate rules for the safe harbor provisions on transfer pricing returns. Transfer pricing refers to the price at which one arm of a company, usually a multinational corporation, transfer goods or services to another division of the same organization in order to calculate each arm’s profit and loss separately. The committ

Govt denies info on black money

- Get link

- Other Apps

TNN, Sep 17, 2010, 03.07am IST NEW DELHI: Reiterating its earlier stand, the government on Thursday declined to part with information regarding bank accounts held by Indian taxpayers in Liechtenstein's LTG Bank in response to an RTI application. The finance ministry said the information received from German authorities had been passed on to income tax authorities and could not be disclosed as it was exempted under Section 8 of the RTI Act. The ministry claimed that disclosure would adversely affect the nation's sovereignty, and the information shared by a foreign country is confidential. In response to an application filed by activist S C Agrawal seeking details of black money stashed in Swiss bank accounts by Indians, the finance ministry said, "There is no verifiable information available about the quantum of Indian money deposited in Swiss banks." Regarding efforts made to retrieve this wealth, the ministry said a writ petition ha

Jethmalani links Sonia to illegal funds in tax havens

- Get link

- Other Apps

Publish Date: Friday,3 September, 2010, at 12:36 PM Doha Time Former federal law minister Ram Jethmalani yesterday alleged several leaders of the ruling Congress Party had illegal funds stashed in foreign tax havens.The Rajya Sabha MP of the Bharatiya Janata Party (BJP) said that huge amounts of money stolen by criminal offenders from the pockets of poor people of India were hidden in foreign banks. “It is increasingly certain that bigwigs of the Congress are involved in these grave crimes, including (party chief) Sonia Gandhi and her son (Rahul),” Jethmalani alleged.He said that the latest protocol with the Swiss government was a further attempt to blockade the acquisition of information about these highly influential criminals.“The protocol does not even make sense. The double taxation treaty has nothing to do with the present situation,” Jethmalani said. India said on Tuesday a tax pact signed with Switzerland should help the government track illicit funds parked in Swiss bank ac

Retrieve Indian Money Stashed Abroad: Prof. Vaidyanathan

- Get link

- Other Apps

Retrieve Indian Money Stashed Abroad: Prof. VaidyanathanIt is possible to retrieve the black money kept abroad if the government has the will to do it, says the professor from IIM Bangalore By YenthaOn Sep 01, 2010 Pulimood, Trivandrum: Professor R Vaidyanathan, the Professor of Finance and Control from IIM Bangalore, said that bringing back the trillions of dollars of Indian money kept in tax safe havens like Switzerland is not so difficult. However, he doubted whether the government had the will to do it. rof. Vaidyanathan talks about the need to get back the Indian money stashed abroad Prof. Vaidyanathan was lecturing on “Effect of Black Money In The Indian Economy” at the monthly lecture conducted by the Bharatiya Vichara Kendram. “When the recession struck the west, countries tried to get the money their citizens had stacked away in tax havens. India should also put pressure on these places to get back their share. Countries like Switzerland have a huge investment in our country.

New India-Swiss pact not for recovering black money: Mukherjee

- Get link

- Other Apps

2010-08-31 16:10:00 Last Updated: 2010-08-31 16:33:29 India's Finance Minister Pranab Mukherjee speaks with the Associated Press ...New Delhi: Union Finance Minister Pranab Mukherjee on Tuesday made it clear that the revised double taxation avoidance agreement that India had signed with Switzerland on Monday would not help the country in getting back the black money stashed away by Indians in Swiss bank accounts. "I would like to make it quite clear, that as far as Swiss laws are concerned, they don't give any information of their banking transactions," Mukherjee taold the Lok Sabha. "Swiss laws on information regarding bank transactions are strictly enforced, and the only information provided would be for taxation purposes," he added. "Swiss banks' transactions is so strictly enforced that only once in 1945, the assets of the Nazi leaders, who were subjected to November 12 (Nuremberg trials) were revealed by the Swiss bank. Before that and after

The I.R.S. said it had received details on 2,000 clients' names from UBS

- Get link

- Other Apps

The Internal Revenue Service said Thursday that it would drop a closely watched civil lawsuit against the Swiss bank giant UBS after the Swiss government said it was on course to hand over details on thousands of American clients suspected of using their accounts to evade taxes. The I.R.S. said it had received details on 2,000 clients so far and expected to receive information on the remaining 2,450 this fall, Lynnley Browning reports in The New York Times. While that is past the Tuesday deadline set in an August 2009 deal between Switzerland and the I.R.S. for the 4,450 names, the agency said it was confident of the country’s intentions to comply with the agreement announced by Swiss officials on Thursday. The statement by the I.R.S. puts to rest a serious headache for UBS, the world’s largest private bank, and for Switzerland over offshore private banking services that enabled wealthy Americans to evade taxes. The I.R.S. had threatened to revive its legal challenge to UBS through a b